Legislative Action Report — March 30, 2015

No bills died this week. With appreciation to our friends and colleagues at Washington State Budget & Policy Center, the State League of Women Voters, and the State Low-Income Housing Alliance, here is a compendium of their budget analyses, which reflect our priorities, particularly for education and human services which are by far the largest part of the operating budget. We ask you also to support their recommended action steps as well as those of the WLIHA and the Budget & Policy Center, remembering that the budget bills will be voted out very soon.

A cutoff calendar is included at the end.

Analysis by the Washington State League of Women Voters:

On Friday the House Democrats released their proposed 2015-17 budget package, including how they plan to pay for it. There will be at least one public hearing on this package, on Monday; and then it is expected to pass the House and move to the Senate.

The Senate, in turn, will adopt its budget, which is expected to look quite different from what was released by the House. Then representatives of both caucuses in both houses of the Legislature will negotiate a final, compromise budget.

Speed is of the essence at this point. The Supreme Court’s anticipated review of the McCleary case compliance (ample state funding for education) on April 27 creates urgency for working rapidly toward a budget compromise. As you know, the state budget must be balanced.

Preliminary analysis of this House proposed budget indicates that it goes farther than the Governor’s budget did to fund basic education, including funding to reduce K-3 class sizes and to assure teachers get their cost of living adjustments and additional benefits. While the shortfall has been estimated at $4.5 billion for this biennium, the Governor proposed an increase of only $2.3 billion. The House budget has an increase of $3.2 billion. The House proposed paying for this by acknowledging new revenue generated by the improved economy, by initiating a capital gains tax, by closing some tax loopholes and by shifting the business and occupation tax rates. The Representatives sponsoring this proposal also spoke of the need to further increase state funding to address the local levies now paying for education but did not say how that would happen. For more information on the capital gains tax, follow this link. This new revenue source would affect only those with means, adding more fairness to the overall tax structure of Washington State.

The House budget proposal also would increase investment in early learning programs, in higher education and mental health, social services and other basic needs. The Governor’s proposed carbon pollution program was not included in the House proposal, but Representatives spoke to their interest in continuing to discuss that option (which League also supports).

Action Suggestions for this Week from the League of Women Voters:

- Contact your representatives and urge them to support the House budget.

- Sign on to the petition circulated by our coalition partner Washington United for Fair Revenue. Find more revenue information by clicking here.

- Listen to the “Where’s the Dough? On the Hunt for Washington’s Tax Dollars” on public radio station KPLU 88.5. You can hear or read the series by clicking here.

Next week we’ll update you on where budget and policy matters stand in our customary format. Thanks for being BOLD advocates.

Pat Dickason, Action Chair and the Lobby Team

From Washington Low-Income Housing Alliance:

First tell your elected officials that you endorse the House budget!

The House budget protects vital services that help people with very low incomes who experience a disability keep their homes. It funds important programs that help homeless young people. And it invests over $110 million in affordable housing! That’s why we need you to urge your legislators to pass this budget out of the House.

The big news is that the capital budget contains $110,200,000 for affordable housing with $80 million specifically for the Housing Trust Fund! But there’s even more good news regarding the operating budget, with just one budget issue that we’re disappointed about. Check out our housing & homelessness analysis of the budgets!

The Washington State Budget & Policy Center posted this analysis on Friday:

House Budget Proposal Prioritizes Funding for Education

Posted by Kim Justice at Mar 27, 2015 10:16 PM | Permalink

The House budget released [this morning] recognizes that fixing our broken revenue system is necessary to make progress toward creating shared prosperity in Washington state (a message that was also detailed in the Progress Index we released earlier this week). The two-year spending proposal prioritizes investments for kids and students using $1.5 billion in new revenue. The House proposal makes sizable investments in early learning, makes college more affordable, and keeps the state on track to fully fund basic education for all children by 2018 (required in the McCleary court case). It does this while also protecting the health, safety, and well-being of Washingtonians. Investment highlights in the budget include:

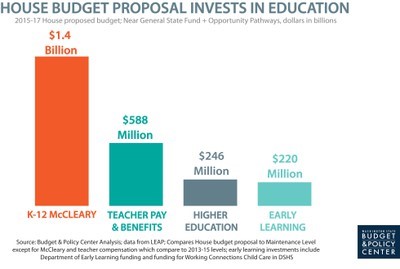

Education* (see graphic for breakdown):

- Adding over 3,000 subsidized child care slots ($72 million)

- Improving the quality and stability of child care ($114 million for Early Achievers and Early Start Act)

- Making the next installment toward fulfilling the constitutional and court-mandated obligation to fully fund basic education ($1.4 billion)

- Providing cost-of-living adjustments and increased health benefits to teachers ($588 million)

- Freezing tuition and increasing financial aid at public colleges and universities ($220 million)

Economic Security**

- Fully restoring the funding that was previously cut for food assistance ($10 million)

- Allowing parents receiving Temporary Assistance to Needy Families to keep a portion of their child support payments ($8 million)

Healthy People & Environment***

- Increasing investments in mental health services ($130 million)

- Adding staff to respond to reports of child abuse and neglect ($16 million)

Raising Revenue

To make these important investments, lawmakers outlined the steps they intend to take to raise additional resources while also addressing our upside-down tax system. These include:

- Taxing high-end capital gains ($570 million): The House plan would apply a new 5 percent tax on profits from the sale of corporate stocks and other financial assets above $50,000 per year for a married couple ($25,000 for singles). Check out our capital gains tax website for more information on why this is a sensible improvement to Washington state’s upside-down tax system.

- Eliminating seven wasteful tax breaks ($300 million) Tax breaks for the following would be eliminated to help fund improvements to schools: travel agents; prescription drug wholesalers; royalties from licensing software, trademarks, and other “intangible” property; oil refineries; bottled water; nonresident shoppers; and banks.

- Ensuring out-of-state retailers play by the rules ($85 million): Due to federal law, most large, out-of-state retailers get a huge advantage over small “brick and mortar” stores located in Washington state: they don’t have to charge sales taxes. The House plan would help level the playing field by requiring out-of-state retailers who have agreements with businesses located in Washington state to apply sales taxes to goods sold here.

- Increasing the Business & Occupation (B&O) tax applied to personal and professional services and reducing taxes for small businesses ($532 million): During the Great Recession, policymakers temporarily increased the B&O tax applied to service businesses — ranging from doctors and lawyers to plumbers and hair stylists — to 1.8 percent from 1.5 percent. That 0.3 percent surcharge expired in 2013. The House plan would reinstate it, but would also increase a tax credit for small businesses. The credit would eliminate B&O taxes for businesses with gross incomes below $100,000 per year. Businesses with gross incomes as high as $200,000 per year would benefit from the expanded credit.

While no revenue is included in the budget proposal for capping and pricing carbon pollution, lawmakers have expressed interest in pursuing a proposal that would yield even more revenue.

Stay tuned to schmudget for more-detailed analysis on the budget and revenue proposals in the coming days.

To learn more about what state lawmakers can do to make progress in Washington State, read our Progress Index. And specifically, read more analysis on:

-

*how state investments are impacting education

-

**how state investments are impacting economic security

-

***how state investments are impacting healthy people and environment

Legislative Cutoff Calendar

| April 1, 2015 | Last day to read in committee reports from opposite house, except House fiscal committees and Senate Ways & Means and Transportation committees. |

|---|---|

| April 7, 2015 | Last day to read in opposite house committee reports from House fiscal committees and Senate Ways & Means and Transportation committees. |

| April 15, 2015* | Last day to consider opposite house bills (5 p.m.) (except initiatives and alternatives to initiatives, budgets and matters necessary to implement budgets, differences between the houses, and matters incident to the interim and closing of the session). |

| April 26, 2015 | Last day allowed for regular session under state constitution. |

| * After the 94th day, only initiatives, alternatives to initiatives, budgets and matters necessary to implement budgets, matters that affect state revenue, messages pertaining to amendments, differences between the houses, and matters incident to the interim and closing of the session may be considered. | |

Compiled by Sarajane Siegfriedt, Co-Chair King County Democrats Legislative Action Committee [email protected]